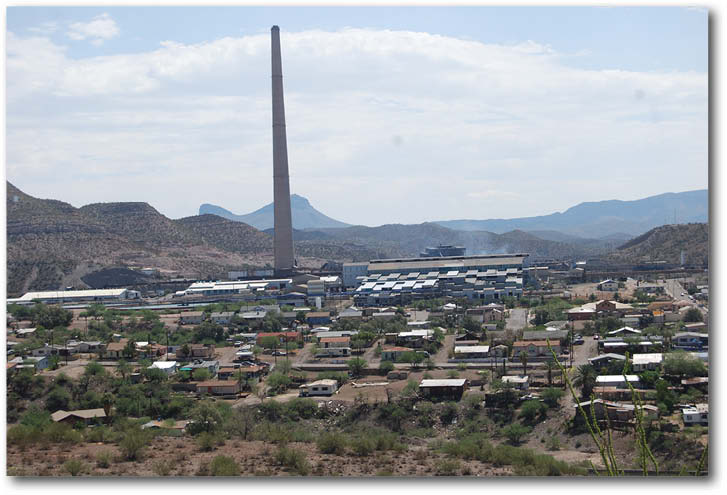

A view from San Pedro overlooks Asarco’s Hayden Smelter, which is at the center of the devaluation issue. John Hernandez | Copper Basin News

Copper Basin News

The Gila County Board of Supervisors met on Monday, Aug. 18, 2014, to approve the tax rates for the entire county. This is an annual function of the Board; the procedure is required by state law and allows the County Treasurer to accept and disburse the property taxes collected.

Normally this procedure is not met with much explanation or discussion as it is mostly a housekeeping procedure.

This year it was much different as the board of Supervisors discussed the centralized valuation submitted by ASARCO for the Hayden Smelter Operations.

In 2013-14 ASARCO reported an assessed value of $13 million. For the 2014-15 budget, ASARCO reported an assessed value of $3 million. The devaluation will cause the personal property taxes of the Hayden and Winkelman residents to double. Local property owners will be forced to pay the taxes levied by the local taxing authorities, town governments and the school district. Those tax bills will be delivered to residents in October.

The overall discussion amongst the Supervisors, County Management and other elected officials was grim. Supervisor Tommie Martin asked if other communities with mines were facing this issue. “Are the other mines devaluing their property?” Based on the levy for the Town of Miami and Miami Unified it did not appear the Freeport McMoRan devalued their properties in Gila County. All of the County supervisors stressed that the County is not the entity imposing these rates and levies.

“This is a grave situation for Hayden/Winkelman, it will have a huge financial impact on our school district in that area. It may force them to close,” explained Supervisor Marcanti.

How will this devaluation affect the homeowners of the area? Because of the fact that ASARCO will not be paying the majority of the tax levy based on their former valuation, the residents will pick up the rest of the levy in their property taxes.

Town of Hayden residents will be paying $8.07 per $100 of assessed value, for Hayden that is a jump of $4.00 from the previous year. Winkelman Residents will be paying $5.89 per $100 of assessed value which is not as much of an increase for town services. The biggest increase will be seen by residents in the Hayden-Winkelman Unified School District. They will have a $12.34 per $100 of assessed value to cover both the primary and secondary tax rates. While the percentages may have been the same regardless of the devaluation, the taxpayers will be paying more of the overall tax levy rather than the majority of the taxes being paid by ASARCO. Several years ago the Gila County Assessor froze the property values in Hayden/Winkelman to provide some tax relief to the residents. The values will remain frozen again this year to maintain some tax relief.

While the average citizen in Arizona can’t call up the county assessor and self asses their property, large corporations and mines can. The state no longer sends out a third party, objective assessor to asses these multi-million dollar company properties. Arizona state law legally allows these companies to self assess their property. They then report it to the Arizona Department of Revenue. Once the Department of Revenue accepts the valuation it is then forwarded on to the County Assessor to be included in the local valuations.

“These days there is a shift with industries passing on the support (tax) for communities onto the residents of those communities. We appreciate the jobs they bring to the economy, but do we wake the sleeping giant?” asked Don McDaniels, Gila County Manager.

Residents may remember about a decade ago ASARCO/Grupo Mexico did not pay any of their property taxes, which once again put the tax burden onto the residents of Hayden and Winkelman. To alleviate the cash flow pinch that the non payment created at the school district, the Arizona State Legislature passed a law to allow the Department of Education to loan the school district the money to keep the school doors open until ASARCO/Grupo Mexico paid its taxes. This situation will be much different than that as there is no legal recourse to fight the devaluation.

Pinal County Supervisor Pete Rios served in the legislature and was instrumental in helping HUSD keep its doors open during that financial crunch. He also expressed much concern for the local residents in Hayden/Winkelman. “At the end of the day, just because you can do it, doesn’t mean you should do it. Shame on you, ASARCO, for placing your tax liability on your workforce.”

ASARCO spokesman, Tom Aldrich provided the following written statement: “For property tax purposes, ASARCO does not set the value on any of our properties; the Arizona Dept. of Revenue does. Every year Asarco submits required data to the Department of Revenue; the most current year was for 2013. The State then calculates the value. The information we receive does not differentiate between Hayden and Ray. As a result of this process, the property taxes fluctuate yearly.”

Copper Area News was unable to talk with the Arizona Department of Revenue prior to press time. We will be following this story and the impacts closely.